Is Greece a Black Swan?

March 3, 2010 | 1 Comments | Analysis, Featured

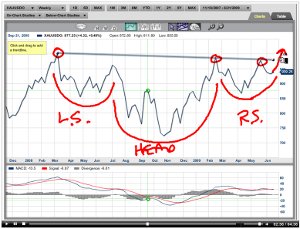

If you’ve been paying attention to the crisis in Greece, you’re probably curious like I am what’s going to happen there. I’m not sure however that you need a strong opinion in order to make money on it.

The Crisis

Ultimately the crisis in Greece boils down to two things:

- The Greeks spent too much and lied about it.

- The other Euro states don’t want them to default, but don’t really want to bail them out.

Germany, the Euro country in the best position to bail them out wants to see serious improvements in their fiscal policy and serious cuts before they extend help. In fact they’re hoping that just hinting around about giving aid will be enough to calm the bond market down. It’s not clear however that their populace will put up with the idea of bailing out Greece so that Greeks can retire 10 years before them. This of course highlights some of the conundrums the EU faces.

The Likely Outcome

Most people think some kind of bail-out will be worked out. Greece will agree to spending cuts and other criteria and the most fiscally fit EU countries will help them out. Order will be restored and faith in the EU will be revived. In fact this is almost assured, because if they don’t bail out Greece, Portugal will probably default right behind them and several countries after that. The EU can’t afford that kind of crisis so they will help, even though they won’t like it.

If you’re confident in this outcome, you could simply buy calls on the FXE. Once order is restored in the European Union, the currency rebound and you’ll rake in the easy money. Of course that’s assuming a lot of things.

The Black Swan

In his book The Black Swan, the author argues (I’m poorly summarizing here), that people by their nature underestimate the likelihood of the improbable. Because of this you should always bet on the improbable because you’re getting better value for your money. This is of course a painful strategy to accept, since most of your bets will be losers. Of course your winners will be magnificent.

In the case of Greece, there is an interesting opportunity to just assume something interesting is going to happen. Simply buy slightly out of the money calls and slightly out of the money puts. If order is restored and the FXE rises, the gains should offset your losses on the puts. If something unforeseen happens, then you will make a fortune on your puts, more than offsetting your losses in the long position. The only situation in which you lose heavily is if the EU manages to punt the issue down the line and keep the FXE where it is. So if you think this is a possibility then you probably wouldn’t want to make this trade.

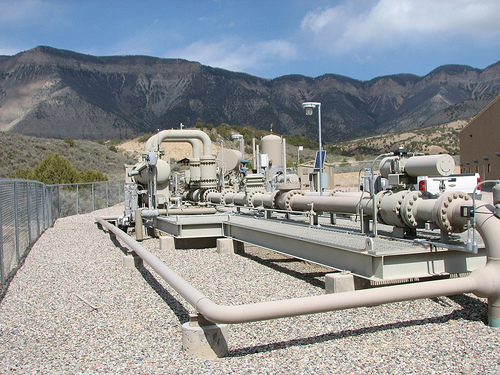

Photo Credit: alaskapine

You probably aren’t as familiar with candlestick charts as you should be. For years I used solely bar charts and trained my mind to read that particular type of chart and I can tell you this: If you’re not using candlesticks you’re probably leaving money on the table.

You probably aren’t as familiar with candlestick charts as you should be. For years I used solely bar charts and trained my mind to read that particular type of chart and I can tell you this: If you’re not using candlesticks you’re probably leaving money on the table.

If you’re trading without a “stop,” you are playing Russian Roulette with your money. “Stop Loss Orders” or “stops” are orders you place with your brokers to indicate that if your position moves against you to a certain point you will exit the trade. You have a “stop price” where if the issue trades at that price or worse, the order turns into a market order to sell or buy. Many traders don’t actually place the order but have a price at which they will exit the trade, which they still call a “stop.” In fact some traders prefer not to place an actual order because they fear they will influence price execution and get “stopped out” when they wouldn’t have otherwise. Regardless of how you execute the exit, you should never enter any position without a price at which you know you’re wrong and get out of the trade.

If you’re trading without a “stop,” you are playing Russian Roulette with your money. “Stop Loss Orders” or “stops” are orders you place with your brokers to indicate that if your position moves against you to a certain point you will exit the trade. You have a “stop price” where if the issue trades at that price or worse, the order turns into a market order to sell or buy. Many traders don’t actually place the order but have a price at which they will exit the trade, which they still call a “stop.” In fact some traders prefer not to place an actual order because they fear they will influence price execution and get “stopped out” when they wouldn’t have otherwise. Regardless of how you execute the exit, you should never enter any position without a price at which you know you’re wrong and get out of the trade.